Transitioning from GST to SST in Malaysia. Application for Import Duty andor Sales Tax Exemption on Machinery Equipment.

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia.

. Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. One of the proposed measures in the bill. 15 Items Exempted from Sales and Services Tax SST Malaysia SST Custom.

Such exemption is granted in the Sales Tax Exemption from Licensing Order 1972. Investor Highlights They came from all over but made Malaysia their home. GETTING READY FOR SALES TAX EXEMPTION APPLICATION.

By Zachary Ho - Jun 22 2022. Proposed measures for sales tax on low-value goods include new requirements for online sellers. 3 rows August 6 2021.

So far a total of 868422 units of vehicles have been sold and the people have benefited from the sales tax exemption amounting to RM47 billion. Proposed legislationknown as The Sales Tax Amendment Bill 2022 and Service Tax Amendment Bill 2022was tabled on 1 August 2022 for first reading in the Parliament. Proton Instagram pic June 20 2022 KUALA LUMPUR The deadline for the sales tax exemption for the purchase of passenger vehicles remains on June 30 2022 Finance Minister Tengku Datuk Seri.

The move was made back then in anticipation of the re-implementation of the sales and services tax SST. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. Any registered manufacturer or person acting on behalf of a registered manufacturer may be exempted from paying sales tax on the importation or acquisition of pallets provided the pallets are used as packaging materials for the exportation or sale of finished goods taxable pursuant to Item 1 or Item 3 Schedule C of the Sales Tax Persons Exempted from.

This is expected to be RM 500 approx. In a recent announcement the Ministry of Finance MoF had agreed to allow car buyers to enjoy the sales tax exemption as long as their vehicles are booked by the 30 June 2022 deadline. Best viewed in Google.

KUALA LUMPUR June 20 Bernama The deadline for the sales tax exemption for the purchase of passenger vehicles remains on June 30 2022 Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz said. However he said the registration period for the purchase of vehicles at the Road Transport. The Ministry of Finance on 20 June 2022 issued a media release regarding the sales tax exemption available with regard to the purchase of passenger cars.

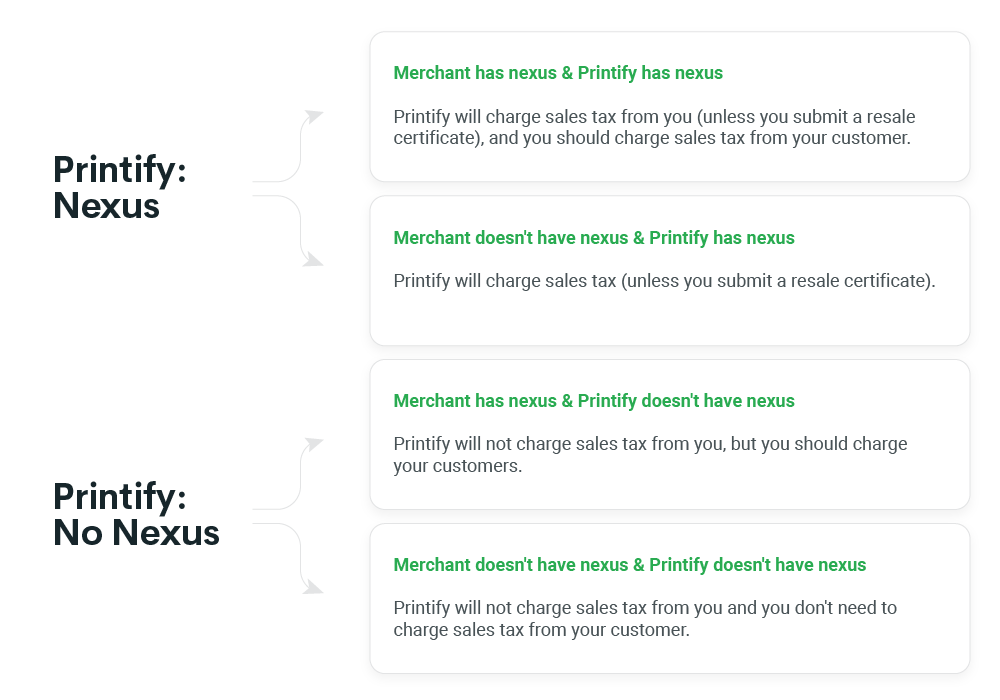

1 Summary on how to apply Exemption for all schedules under Sales Tax Persons Exempted from Payment Of Tax 2018. Exemption from payment of sales tax Minister may exempt any person from payment of sales tax charged and levied on any taxable goods manufactured or imported Subject to conditions Approval on individual basis Exemption by Sales Tax Persons Exempted From Sale Tax Order 2018 Specific person or to class or category of person. The sales tax exemption is fundamentally similar to the tax holiday that Malaysians enjoyed between June to August 2018 during which the goods and service tax GST was zero-rated from all vehicle prices.

Breaking Down the SST in Malaysia. The abovementioned Exemption Order refers to the Sales Tax Persons Exempted from Payment of Tax Order 2018. Setting Up in Malaysia.

SST Malaysia to Impose 5-10 Tax on Goods and 6 on Services. 08062020 1212 AM. Exported manufactured goods will be excluded from the sales tax act.

However at the same time not all products are necessary to be taxed. Service Sector Remain 6 from GST into SST in Malaysia. 11 rows HOW TO APPLY EXEMPTION UNDER SALES TAX PERSONS EXEMPTED FROM PAYMENT OF TAX 2018.

Malaysia Sales Service Tax SST. Legislation to impose Sales Tax on low-value goods from 1 January 2023 to be finalised Following the Malaysian National Budget last year draft amendments to the Sales Tax laws have been tabled at the Parliament to impose Sales Tax on the imports of goods being sold to consumers under to-be-set threshold. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya.

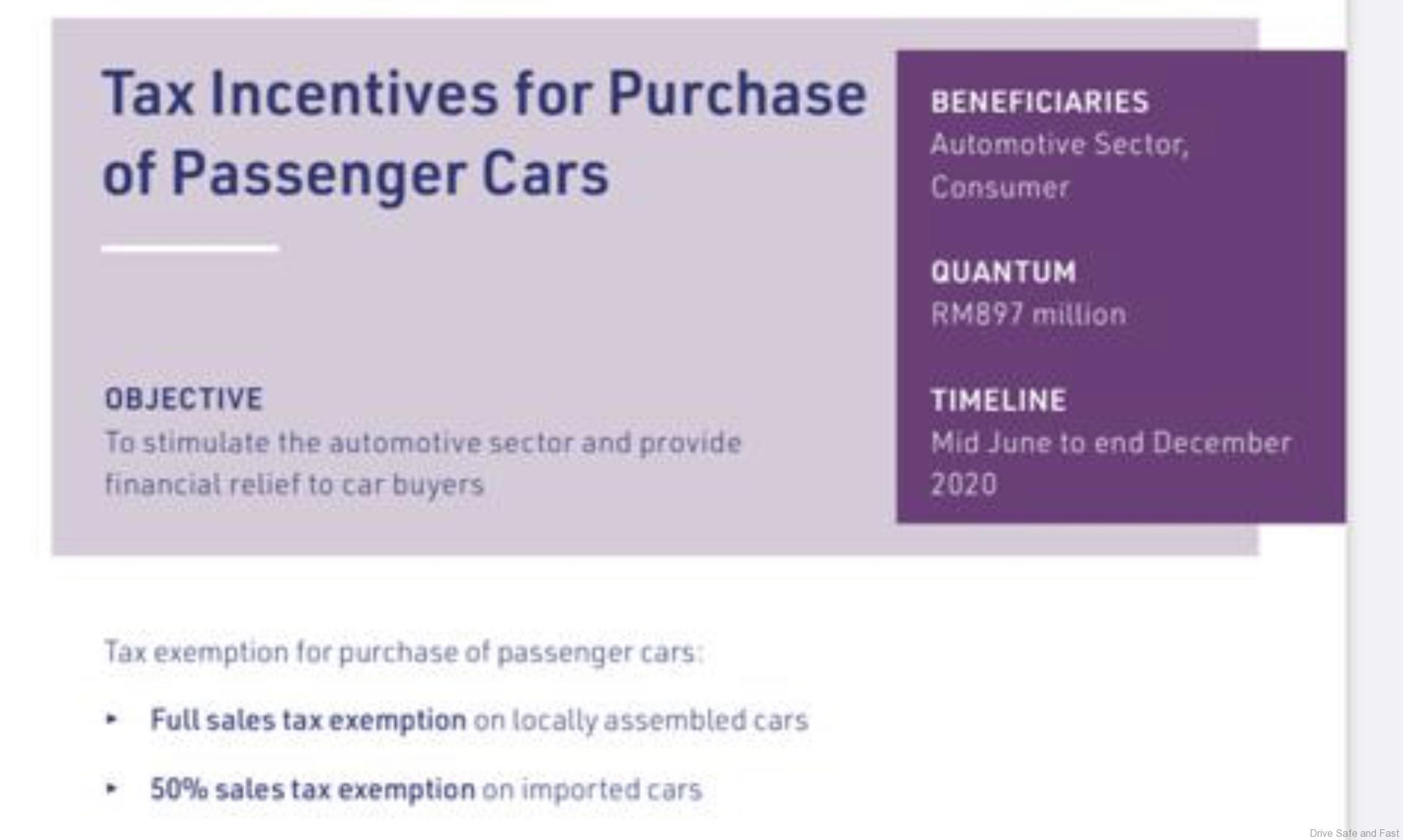

The sales tax exemptionreduction is applicable from 15-June to 31-December 2020. Exempt goods and goods taxable at 5 are defined by the HS tariff code. Download the respective format.

Exemption from the Sales Tax under clause 99 Table B Sales Tax Order Exemption 1980 is a facility provided for the benefit of local factory operators that manufactures goods that are exempted from the Sales Tax which are meant for export and also on control items under the Ration Control Act 1961 which is bound under the. Any registered manufacturer to importpurchase raw materials components and packaging materials excluding petroleum exempted from the payment of sales tax formerly CJ5. Find out more about their investment journey here.

As you already know the government has announced that it will be waiving the 10 percent sales tax for locally-assembled CKD cars while imported CBU cars will see their sales tax reduced by half to 5 percent. Application for Import Duty Exemption on. Item 1 Schedule C.

The Malaysian authorities updated information with regards to the sales tax. Perodua welcomes the extension of the sales and service tax exemption period for new cars which was supposed to end on 30 June 2022. Vehicle sales tax exemption deadline remains on june 30 MoF.

Sales tax exemption on purchase of passenger cars ends 30 June 2022. Download form and document related to RMCD. The Schedule A of the Sales Tax Exemption from Licensing Order 1972 stipulates that manufacturers with an annual sales turnover of taxable goods not exceeding RM100000 are exempted from the requirement of applying for a sales tax licence.

The sales tax rate is at 510 or on a specific rate or exempt. Note that this is the first Policy issued by RMCD on Sales Tax matters. According to the release the sales tax exemptionan exemption that began 15 June 2022 for 100 of the.

Importer may be exempted from payment of Sales Tax under Item 39 Schedule A of the Exemption Order upon re-importation of the pallets.

Stockx Goat And Avoiding Sales Tax Plugd Blog

Understanding Sales Tax With Printify Printify

The Sales Tax Is Not Automatically Being Added To My Client Invoice How Can I Fix This

Sales Tax Exemption For Ckd 100 And Cbu Cars 50

The Sales Tax Is Not Automatically Being Added To My Client Invoice How Can I Fix This

Shopify Sales Tax The Ultimate Guide For Merchants Updated 2020 Avada Commerce Sales Tax Tax Consulting Tax

Invent Avalara Connectwise Marketplace

How To Get Exemption Of Sales Tax Under Exports

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

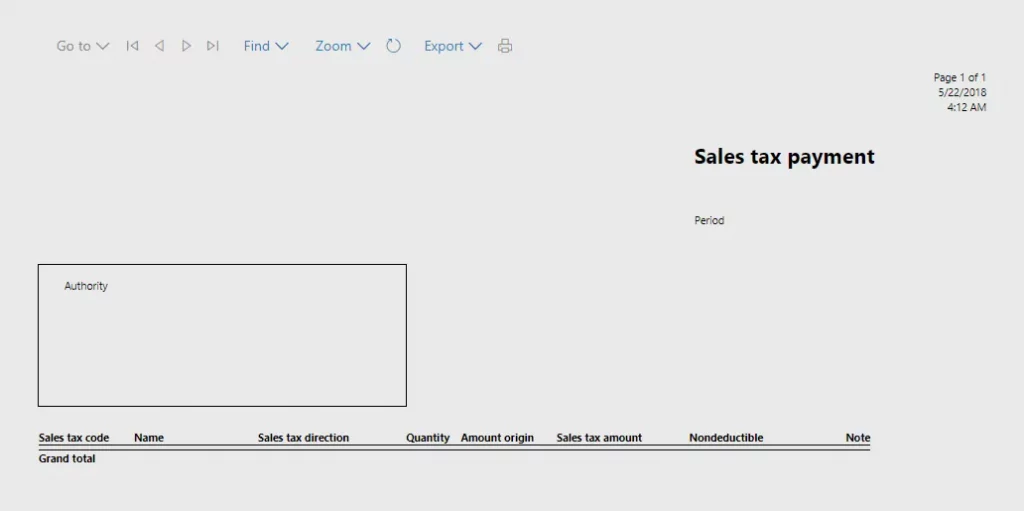

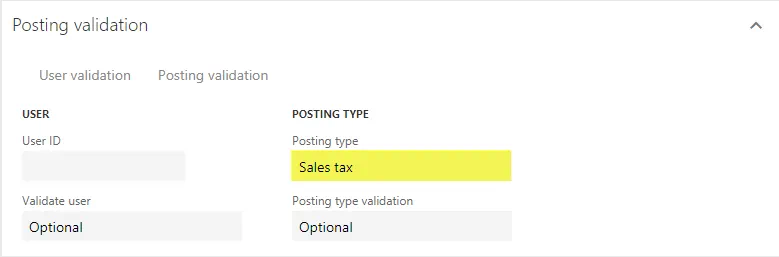

How To Manage Conditional Sales Tax In Dynamics 365 For Finance And Operations Hitachi Solutions

How To Manage Conditional Sales Tax In Dynamics 365 For Finance And Operations Hitachi Solutions